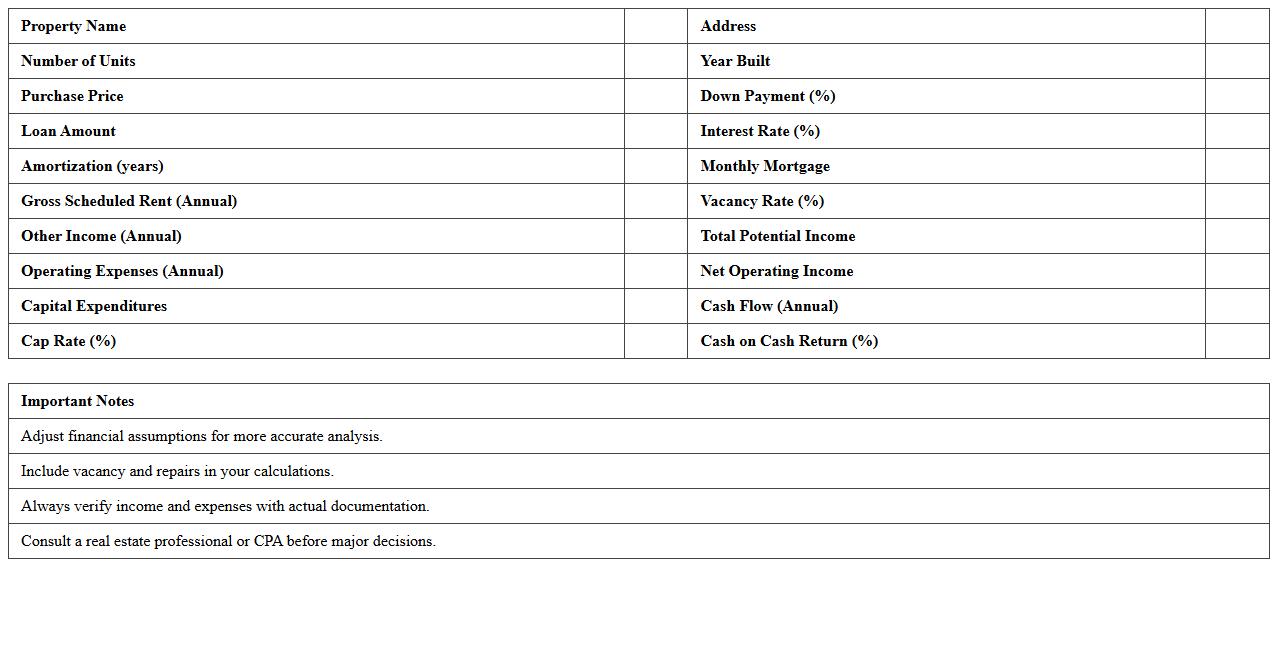

Multifamily Real Estate Deal Analyzer Excel Template

The

Multifamily Real Estate Deal Analyzer Excel Template is a powerful tool designed to evaluate the financial performance of multifamily property investments by analyzing key metrics such as cash flow, cap rate, internal rate of return (IRR), and net operating income (NOI). This template streamlines complex calculations, enabling investors to make informed decisions by comparing potential deals quickly and accurately. It enhances deal structuring and risk assessment, providing a clear snapshot of investment viability and projected returns.

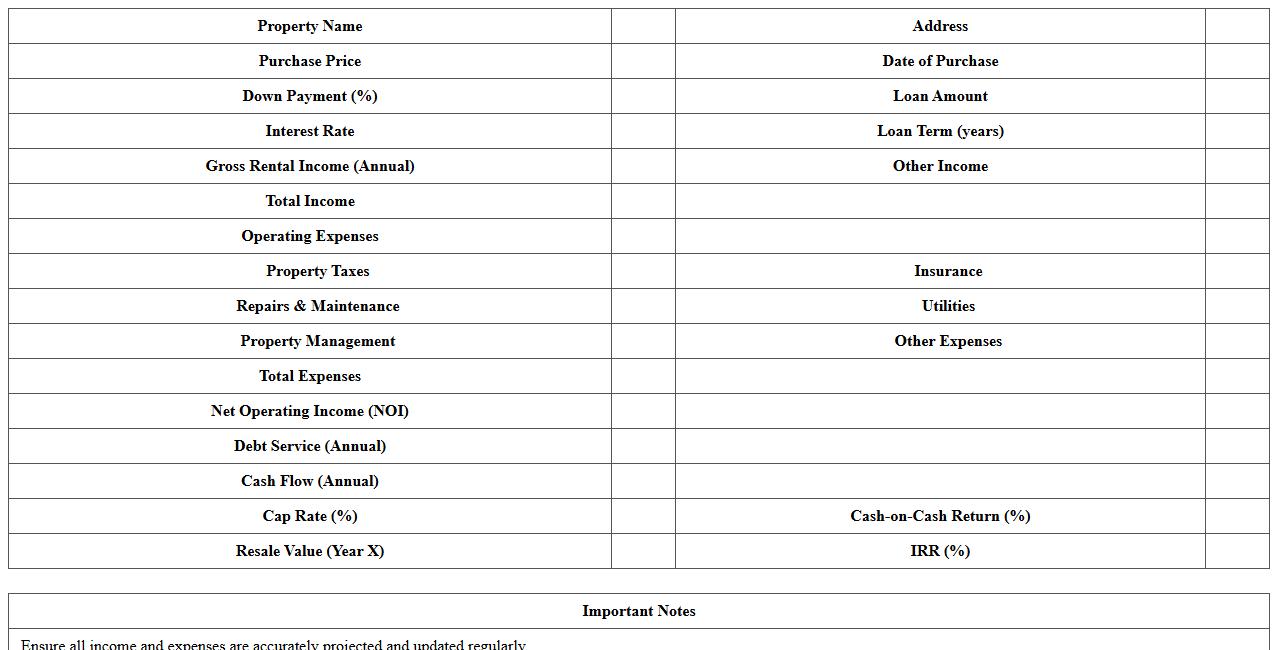

Commercial Property Investment Analysis Spreadsheet

A

Commercial Property Investment Analysis Spreadsheet is a comprehensive tool designed to evaluate the financial viability and potential returns of commercial real estate investments. It systematically organizes income, expenses, cash flow projections, and key metrics such as cap rate, ROI, and net present value, enabling investors to make informed decisions. This document streamlines complex data analysis, helping users identify profitable opportunities and manage risks effectively in the commercial property market.

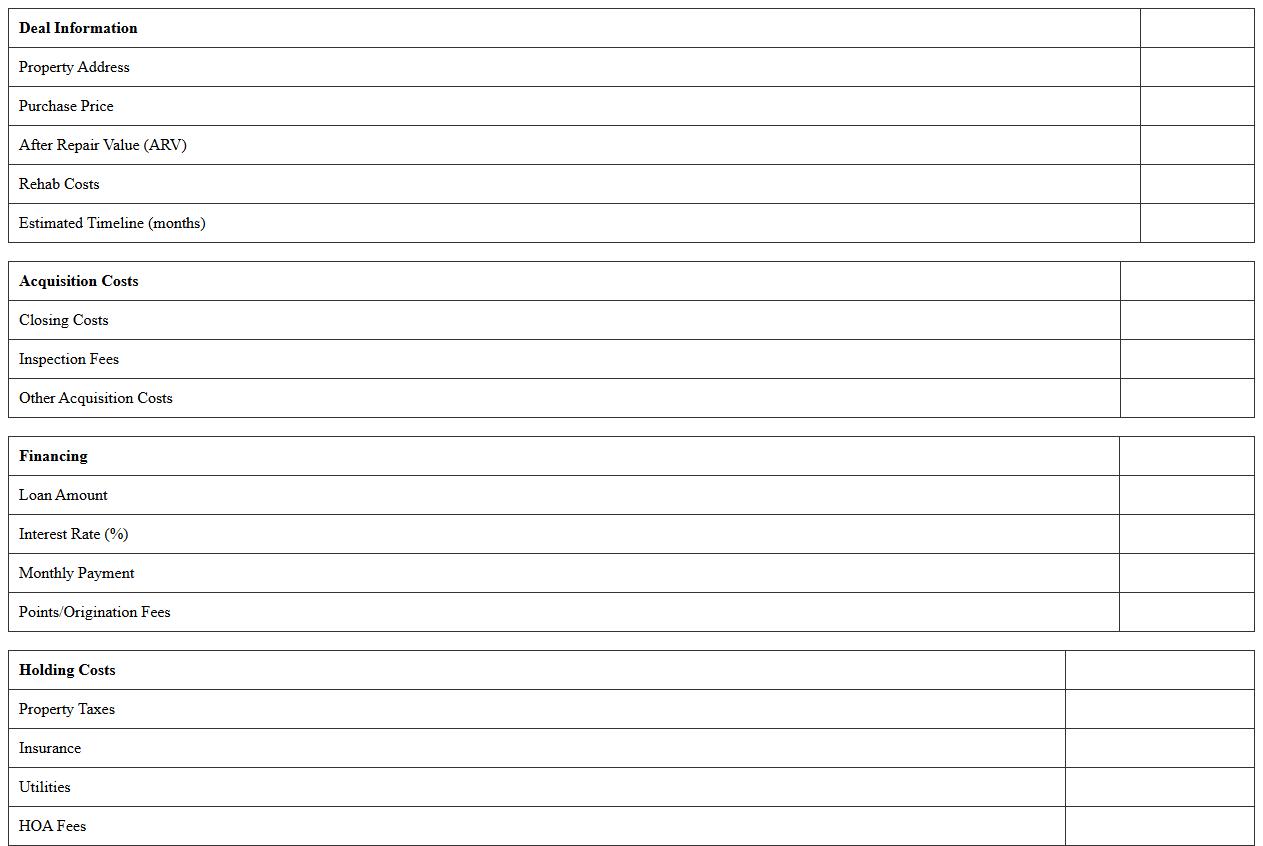

Residential Flip Deal Analyzer Excel Worksheet

The

Residential Flip Deal Analyzer Excel Worksheet is a powerful financial tool designed to evaluate the profitability of house flipping projects by calculating key metrics such as renovation costs, purchase price, after-repair value (ARV), and potential profit margins. This worksheet helps real estate investors make informed decisions by providing a clear breakdown of expenses, timelines, and returns on investment, reducing the risk of unexpected costs and maximizing profitability. By streamlining the analysis process, it enables users to quickly compare multiple properties and prioritize the most lucrative flipping opportunities.

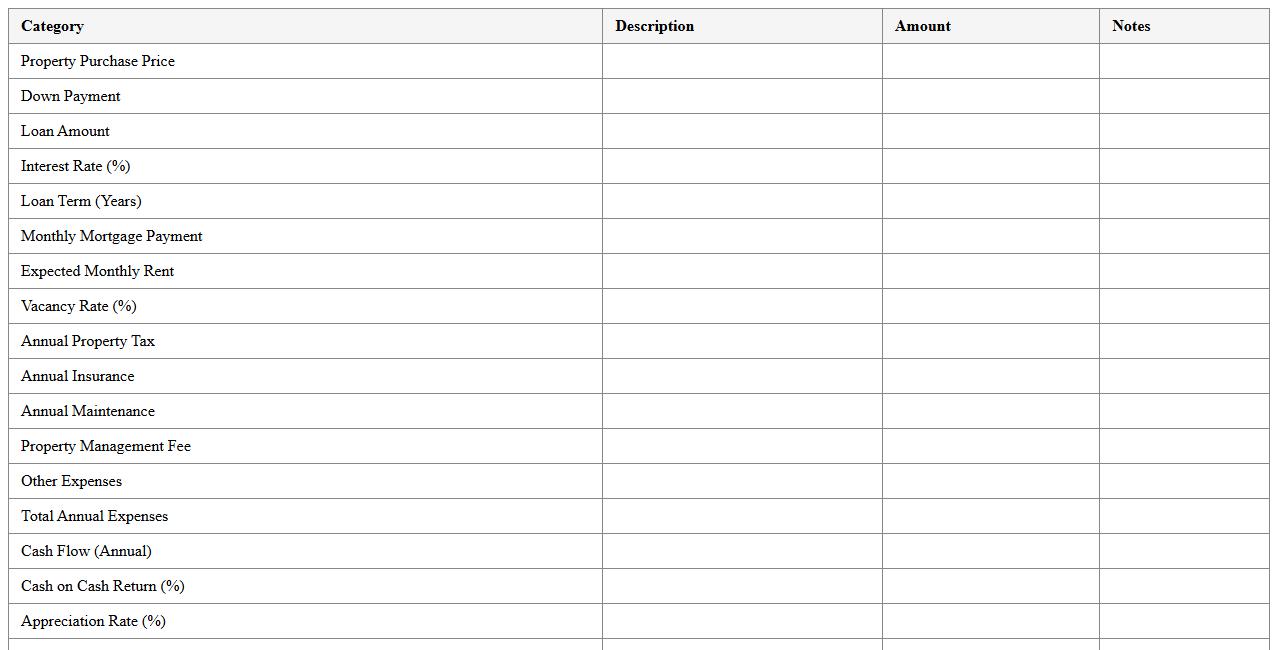

Buy and Hold Rental Property Calculator Excel

The

Buy and Hold Rental Property Calculator Excel is a financial tool designed to analyze the long-term profitability of rental real estate investments by calculating key metrics like cash flow, return on investment (ROI), and net present value (NPV). It helps investors forecast expenses, rental income, mortgage payments, and potential appreciation, enabling informed decision-making. This calculator simplifies complex financial data into clear insights, making it easier to evaluate the viability of holding rental properties over time.

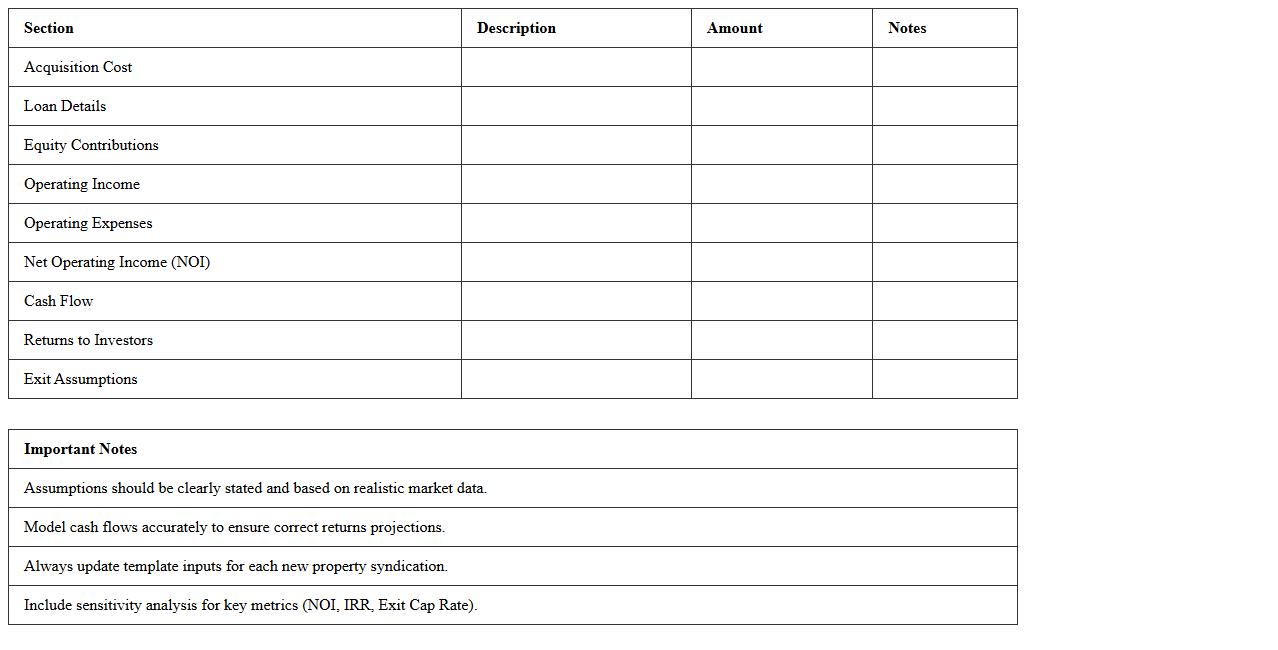

Real Estate Syndication Financial Model Template

A

Real Estate Syndication Financial Model Template is a detailed spreadsheet tool designed to forecast investment returns, structure equity distributions, and analyze cash flow for property syndications. It enables investors and sponsors to evaluate potential real estate deals by projecting income, expenses, and loan parameters, facilitating data-driven decisions. This model streamlines complex financial calculations, improves transparency, and enhances communication among stakeholders throughout the investment lifecycle.

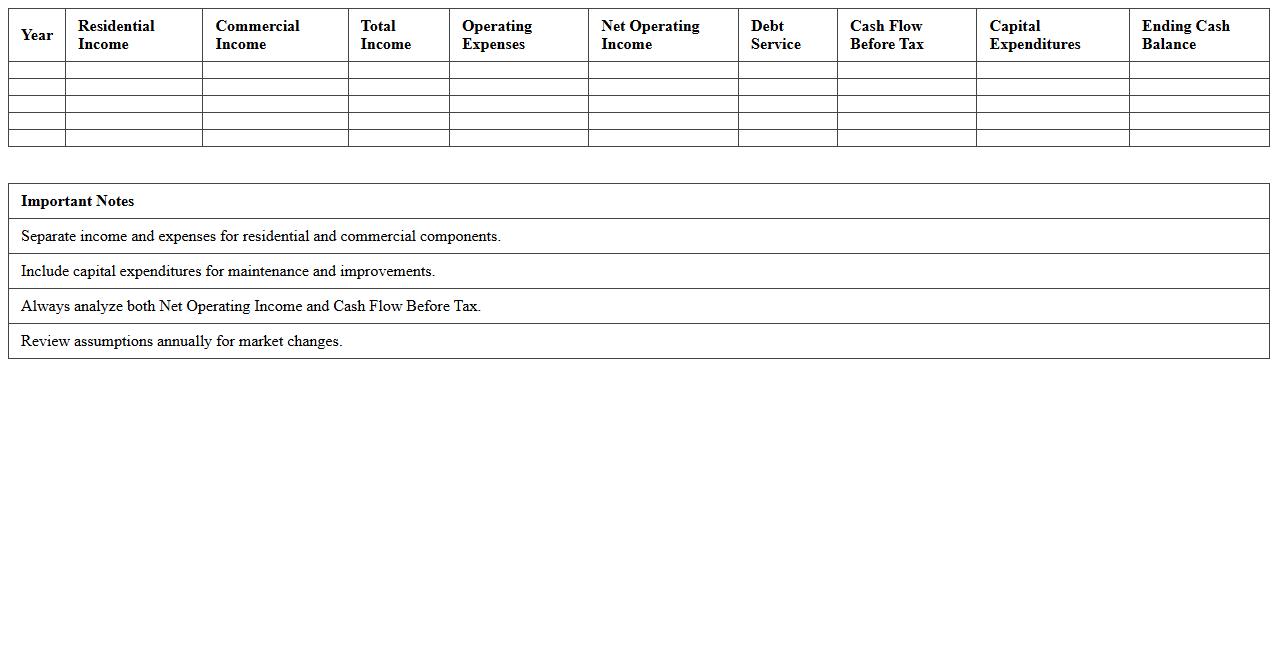

Mixed-Use Real Estate Cash Flow Analysis Excel

A

Mixed-Use Real Estate Cash Flow Analysis Excel document is a financial tool designed to evaluate income, expenses, and profitability of properties combining residential, commercial, and retail spaces. It enables investors, property managers, and developers to project cash inflows and outflows, assess investment viability, and optimize revenue streams across multiple property types. By systematically organizing data and performing complex calculations, this Excel model enhances decision-making and strategic planning for mixed-use real estate projects.

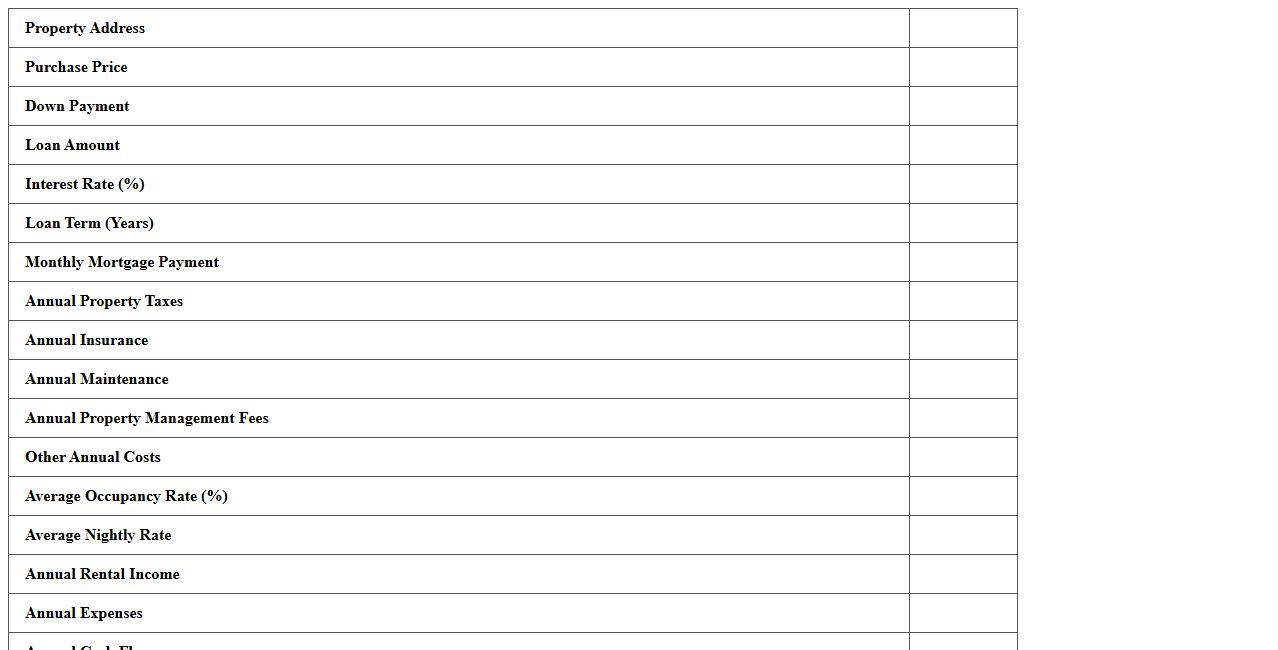

Vacation Rental Investment ROI Calculator Excel

A

Vacation Rental Investment ROI Calculator Excel document is a specialized tool designed to analyze the profitability of vacation rental properties by calculating the return on investment (ROI). It helps investors input key financial data such as purchase price, rental income, operating expenses, and financing costs to generate clear insights into potential earnings and cash flow. This calculator streamlines the decision-making process, enabling users to evaluate investment performance and optimize property management strategies effectively.

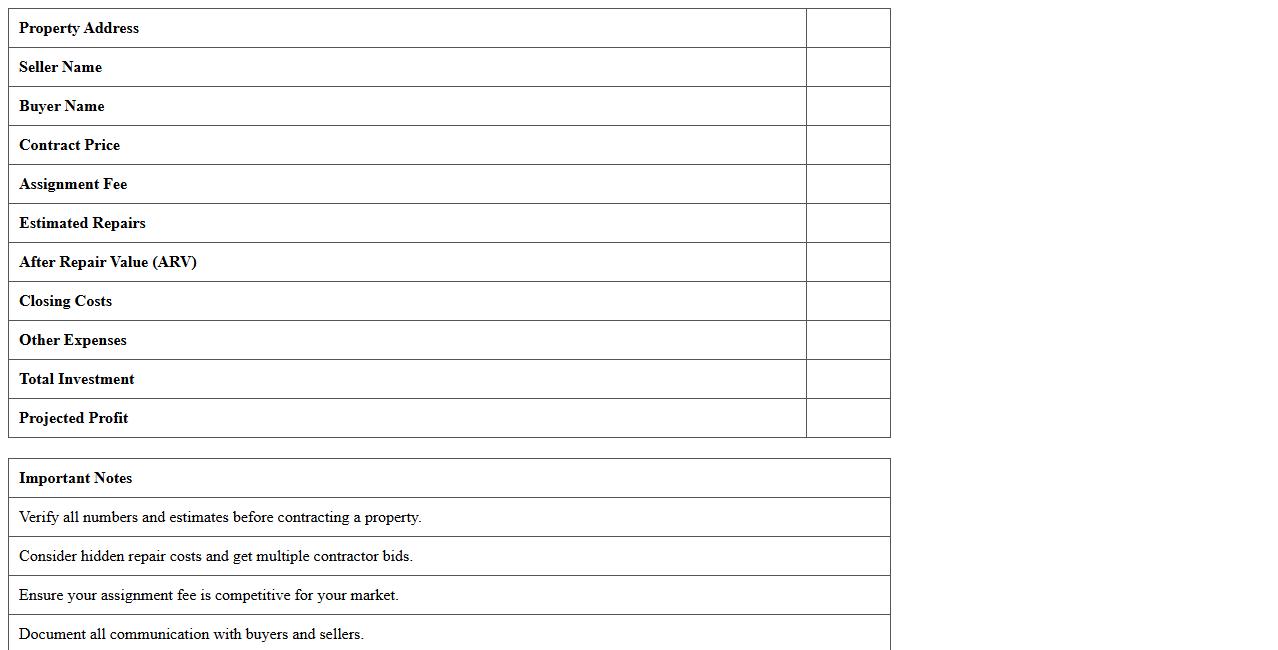

Real Estate Wholesale Deal Analysis Spreadsheet

A

Real Estate Wholesale Deal Analysis Spreadsheet is a comprehensive tool designed to evaluate potential wholesale property deals by organizing and calculating key financial metrics such as purchase price, repair costs, ARV (After Repair Value), and profit margins. It aids investors in quickly assessing the viability and profitability of a deal, enabling data-driven decisions and minimizing risks in real estate wholesaling. By streamlining complex financial calculations and presenting clear insights, this spreadsheet enhances efficiency and accuracy in deal analysis.

Land Development Deal Analyzer Excel Template

The

Land Development Deal Analyzer Excel Template is a comprehensive financial modeling tool designed to evaluate the viability and profitability of land development projects. It streamlines data input, performs detailed cost and revenue analysis, and generates key metrics like internal rate of return (IRR) and net present value (NPV), enabling developers and investors to make informed decisions. This template enhances project assessment efficiency by consolidating complex calculations into an accessible format, reducing risk and optimizing investment strategies.

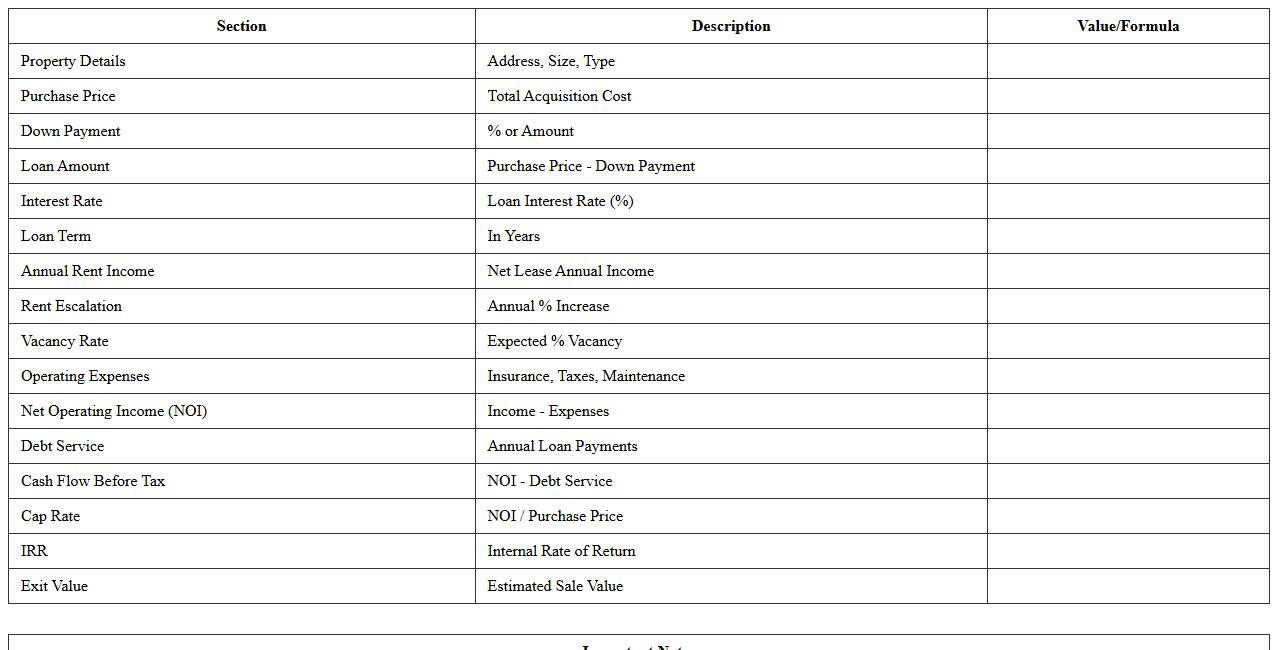

Triple Net Lease Property Investment Excel Model

The

Triple Net Lease Property Investment Excel Model document is a comprehensive financial tool designed to analyze the performance of real estate investments where tenants are responsible for property expenses such as taxes, insurance, and maintenance. This model helps investors accurately project cash flows, evaluate property valuation, and assess risks associated with triple net leases, enabling informed decision-making. Its detailed breakdown of lease terms and financial metrics simplifies complex calculations, enhancing investment strategy and portfolio management.

What formulas are used for calculating cash-on-cash return in the Real Estate Deal Analyzer Excel?

The cash-on-cash return formula is calculated by dividing the annual pre-tax cash flow by the total cash invested. This measure helps investors evaluate the cash income relative to the actual money spent. In Excel, it typically appears as =Annual Cash Flow / Total Cash Invested.

How does the analyzer handle variable interest rates for investor projections?

The analyzer uses dynamic formulas that adjust loan interest calculations based on changing rates entered by the user. It can incorporate rate changes at specified periods to reflect real market conditions. This produces more accurate cash flow and profitability projections over time.

Can the Excel tool auto-generate amortization schedules based on inputted loan terms?

Yes, the tool contains built-in amortization schedule formulas that automatically calculate payments, interest, and principal breakdowns. Users input loan amount, interest rate, and term, and the schedule updates accordingly. This feature simplifies loan tracking and forecasting.

Are there preset templates for multifamily versus single-family deal analysis?

The Real Estate Deal Analyzer includes customized templates tailored for multifamily and single-family properties. Each template features unique line items and metrics suitable for the respective property type. This differentiation enhances analysis accuracy and relevance.

Does the analyzer include sensitivity analysis for rent and expense fluctuations?

Yes, the analyzer integrates sensitivity analysis tools allowing users to test variations in rent and expenses. This helps evaluate how changes impact overall returns and risk exposure. The functionality supports informed decision-making under uncertain market conditions.